Apple’s Role in Taylor Swift’s Album Release

Last week, it was reported that Apple is close to acquiring Nashville’s Big Machine Label Group. With BMLG’s deal with UMG now over, Apple has set their sights on the independent titan for an estimated $250 million dollars.

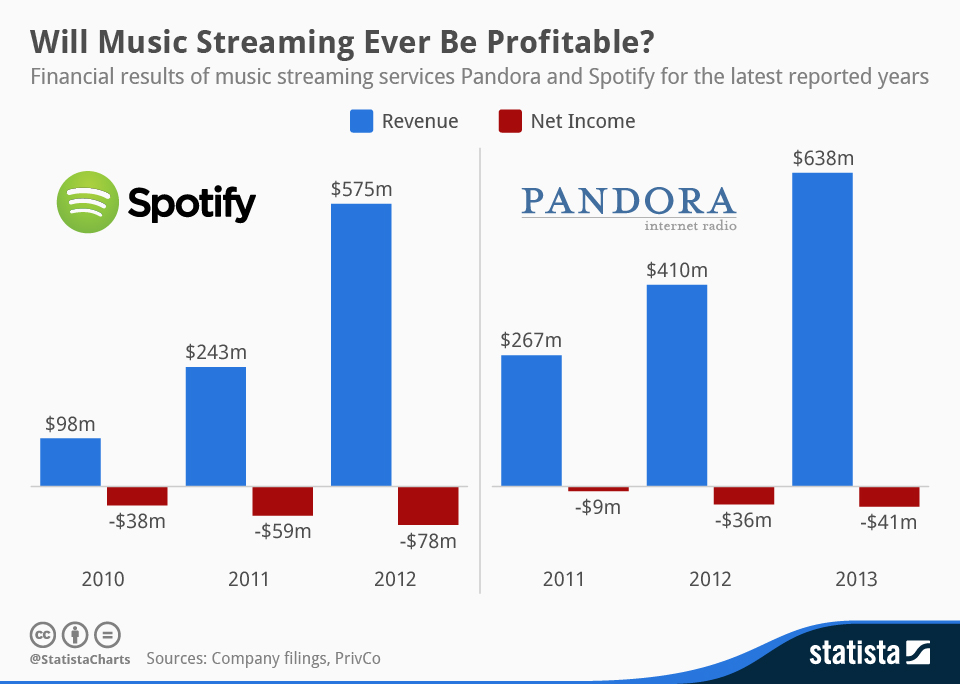

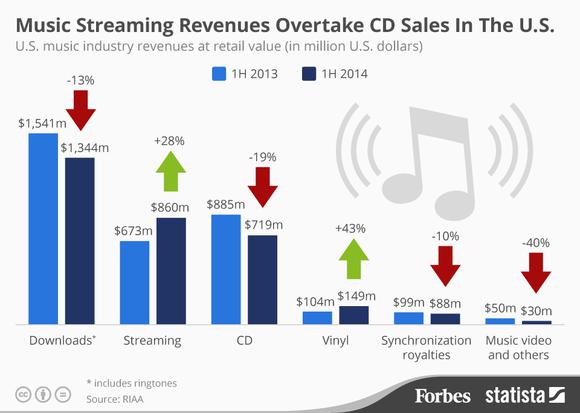

This news comes just months after BMLG superstar Taylor Swift pulled her music from Spotify shortly after earning the highest grossing single on the service. Taylor removed her music after determining the revenues earned from streaming were not not in line with what she believed the value to be, even though she was one of the highest grossing artist on the platform.

“I’m always up for trying something,” Swift told TIME about joining Spotify. “And I tried it and I didn’t like the way it felt. I think there should be an inherent value placed on art. I didn’t see that happening, perception-wise, when I put my music on Spotify. Everybody’s complaining about how music sales are shrinking, but nobody’s changing the way they’re doing things.”

Apple bet big on music streaming and technology when they purchased Beats Audio for a massive 3 billion dollars back in August 2014. The price being debated: $7.99 per month, down from Beats’ now-standard — and arguably too high — $9.99 a month, with no “freemium” model. (The sweet spot for consumers, at which profit is maximized for the labels: $3.99 to $4.99, say experts.)

The news of acquiring BMLG could bring together what is rumored to be the most efficiently priced streaming service on the market with one of streaming music’s biggest brands, and the upside could be huge. Taylor still owes BMLG another album, and with it comes streaming rights. If Apple owns the exclusive rights to Taylor’s distribution rights, they will drive inherently more value to Apple’s Streaming service by being the only media company with access to “Swifties”… or Taylor’s crazed teens fanbase roughly 12-24 year old.

With first-quarter revenue of $74.6 billion as of Jan. 27, Apple has their sights set on more than just streaming. Apple’s presence in the music business, “is to be the music business; it’s not to compete with Spotify.”, says Billboard insider. The proof is in the 800 million credit cards it already has on file — comparably, Spotify has 15 million subscriptions and 60 million monthly users, although the service is growing, headed to an initial public offering.

There is no doubt that the race for streaming control is on (Jay Z’s recent acquisition of Aspiro is testament to that). Music has become one of the most engaging forms of content on the web, which is great for companies and advertiser who rely on big data. But with operating costs so high, will streaming ever be profitable?

Let us know what you think if the comment section below.